Originally posted by Sparko

View Post

Announcement

Collapse

Civics 101 Guidelines

Want to argue about politics? Healthcare reform? Taxes? Governments? You've come to the right place!

Try to keep it civil though. The rules still apply here.

Try to keep it civil though. The rules still apply here.

See more

See less

It's the Economy, Stupid!

Collapse

X

-

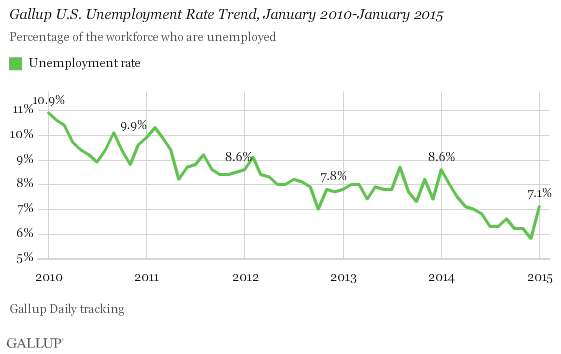

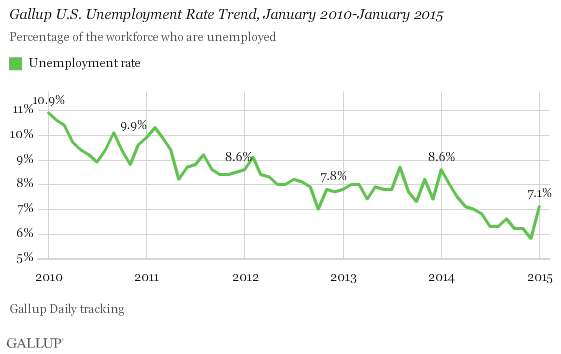

Originally posted by Juvenal View PostThat's not true, either. When Gallup publishes unemployment charts, unlike irresponsible sources, like the Moonie Times, they use seasonally adjusted figures, so as not to mislead their readers.

It is true. here is the very same chart on Gallup's website:

https://content.gallup.com/origin/ga...1ujaymztqg.png

Comment

-

Points. Bonus points if you can find it used for analysis.Originally posted by Sparko View PostIt is true. here is the very same chart on Gallup's website:

https://content.gallup.com/origin/ga...1ujaymztqg.png

Compare to the chart Gallup uses:

2019-12-27_12-52-02.jpg

Widely reported unemployment metrics in the U.S. do not accurately represent the reality of joblessness in America.

For example, the U.S. Bureau of Labor Statistics (BLS) does not count a person who desires work as unemployed if he or she is not working and has stopped looking for work over the past four weeks. Similarly, the BLS does not count someone as unemployed if he or she is, for instance, an out-of-work engineer, construction worker or retail manager who performs a minimum of one hour of work a week and receives at least $20 in compensation.

To measure unemployment, Gallup recommends using what we call the "Real Unemployment" metric from the BLS -- which combines those who are unemployed, underemployed and marginally attached to the workforce.

Ask yourself, why did the Moonie Times choose to avoid the seasonal adjustments. Why did they choose that timeframe. Read the difference in the charts. Draw a best fit line, even by eye, and you can see the trendlines are the same. By avoiding the seasonal adjustments and ending on a regular end-of-year spike, they were able to mislead casual readers. Standard analysis didn't show what the Moonie Times wanted it to show. That sort of mistake doesn't happen by accident.

Comment

-

The Bolded (mine) is exactly what the "moonie times" was saying.Originally posted by Juvenal View PostPoints. Bonus points if you can find it used for analysis.

Compare to the chart Gallup uses:

[ATTACH=CONFIG]41680[/ATTACH]

Widely reported unemployment metrics in the U.S. do not accurately represent the reality of joblessness in America.

For example, the U.S. Bureau of Labor Statistics (BLS) does not count a person who desires work as unemployed if he or she is not working and has stopped looking for work over the past four weeks. Similarly, the BLS does not count someone as unemployed if he or she is, for instance, an out-of-work engineer, construction worker or retail manager who performs a minimum of one hour of work a week and receives at least $20 in compensation.

To measure unemployment, Gallup recommends using what we call the "Real Unemployment" metric from the BLS -- which combines those who are unemployed, underemployed and marginally attached to the workforce.

Ask yourself, why did the Moonie Times choose to avoid the seasonal adjustments. Why did they choose that timeframe. Read the difference in the charts. Draw a best fit line, even by eye, and you can see the trendlines are the same. By avoiding the seasonal adjustments and ending on a regular end-of-year spike, they were able to mislead casual readers. Standard analysis didn't show what the Moonie Times wanted it to show. That sort of mistake doesn't happen by accident.

Comment

-

More reading, less drooling, please.Originally posted by Sparko View PostThe Bolded (mine) is exactly what the "moonie times" was saying.

This is also not true. Here is what the Moonie Times was saying.

Here's Clifton's piece, used for support, but not linked by Lambro because editorial standards are for honest publications, not the Moonie Times:

Here's something that many Americans -- including some of the smartest and most educated among us -- don't know: The official unemployment rate, as reported by the U.S. Department of Labor, is extremely misleading.

Using the official rate is not juggling.

The official U-3 rate and Clifton's, hence Gallup's, preferred U-6 tell the same story of declining joblessness throughout Obama's term. So does U-5.

u6-unemployment-rate-2019-12-28-macrotrends.jpg

Enough juggling, Sparko. You said something that wasn't true:

I prefer to believe you were simply misinformed, led astray by evil companions. But your continuing attempts to run away and hide from your false statements instead of growing enough backbone to own them are beginning to make me doubt your intentions.Originally posted by Sparko View PostWhile Obama did help the economy recover after the housing crash, he did not grow the economy. It was stagnant under him and unemployment rose as well as prices.

The right response to spreading lies is to call for a cleanup crew, not continuing to engage on a discussion board. While mulling over your continuing relevance in these discussions, here's some light reading material to dust up with.

Trump boasts the economy is the best it's ever been. Here are 9 charts showing how it's fared compared to the Obama and Bush presidencies.

Or you could stick with the Moonie Times.

Comment

-

Even according to your chart unemployment rose under Obama. Way up the first two years and then slowly back down to about what it was under Bush.Originally posted by Juvenal View PostMore reading, less drooling, please.

This is also not true. Here is what the Moonie Times was saying.

Here's Clifton's piece, used for support, but not linked by Lambro because editorial standards are for honest publications, not the Moonie Times:

Here's something that many Americans -- including some of the smartest and most educated among us -- don't know: The official unemployment rate, as reported by the U.S. Department of Labor, is extremely misleading.

Using the official rate is not juggling.

The official U-3 rate and Clifton's, hence Gallup's, preferred U-6 tell the same story of declining joblessness throughout Obama's term. So does U-5.

[ATTACH=CONFIG]41709[/ATTACH]

Enough juggling, Sparko. You said something that wasn't true:

I prefer to believe you were simply misinformed, led astray by evil companions. But your continuing attempts to run away and hide from your false statements instead of growing enough backbone to own them are beginning to make me doubt your intentions.

The right response to spreading lies is to call for a cleanup crew, not continuing to engage on a discussion board. While mulling over your continuing relevance in these discussions, here's some light reading material to dust up with.

Trump boasts the economy is the best it's ever been. Here are 9 charts showing how it's fared compared to the Obama and Bush presidencies.

Or you could stick with the Moonie Times.

Comment

-

Yeah it's odd, its almost as if an economic recession took place around then.Originally posted by Sparko View PostEven according to your chart unemployment rose under Obama. Way up the first two years and then slowly back down to about what it was under Bush.

Kinda like how it rose under Bush right around 9/11. I'm sure it had nothing to do with stuff that was happening, I'm suuuuuure it's because he was a bad president.

Comment

-

I never said he was a "bad" president. I think Obama was average. He didn't do all that much for the economy though. It pretty much slowly rebounded on it's own. Obama pretty much let the people who caused the housing crisis off with golden parachutes instead of jail time. People like to complain about Trump catering to the Rich. Obama sure did.Originally posted by Leonhard View PostYeah it's odd, its almost as if an economic recession took place around then.

Kinda like how it rose under Bush right around 9/11. I'm sure it had nothing to do with stuff that was happening, I'm suuuuuure it's because he was a bad president.

Comment

-

That's just not true, man. It didn't rebound on its own. The federal reserve pumping trillions into international banks to uphold the market caused the "rebound." Which is why calling it a real recovery is debatable, and why the argument of Obama vs. Trump is so dumb. The market kept everything sustained and still is, which is why the federal reserve reversed course under Trump and has continued to pump billions into the financial system once again, and is why Trump incessantly whines about interest rates and the Fed doing more QE.Originally posted by Sparko View PostI never said he was a "bad" president. I think Obama was average. He didn't do all that much for the economy though. It pretty much slowly rebounded on it's own. Obama pretty much let the people who caused the housing crisis off with golden parachutes instead of jail time. People like to complain about Trump catering to the Rich. Obama sure did.

Comment

-

Um, if you don't mind, could you repeat that in English, please?Originally posted by seanD View PostThat's just not true, man. It didn't rebound on its own. The federal reserve pumping trillions into international banks to uphold the market caused the "rebound." Which is why calling it a real recovery is debatable, and why the argument of Obama vs. Trump is so dumb. The market kept everything sustained and still is, which is why the federal reserve reversed course under Trump and has continued to pump billions into the financial system once again, and is why Trump incessantly whines about interest rates and the Fed doing more QE.

<grabs notebook to takes notes>"He is no fool who gives what he cannot keep to gain that which he cannot lose." - Jim Elliot

"Forgiveness is the way of love." Gary Chapman

My Personal Blog

My Novella blog (Current Novella Begins on 7/25/14)

Quill Sword

Comment

-

It's pretty complex, but it goes like this. The market sustains the economy and the federal reserve sustains the market. Political polices do very little to affect this. Even Trump's tax cuts did little to affect it, at least permanently, and I'll show you why.Originally posted by Teallaura View PostUm, if you don't mind, could you repeat that in English, please?

<grabs notebook to takes notes>

You can match the chronology of all this. During the crash of 2008, the federal reserve (Fed) lowered interest rates (it's not really that important to understand right now). Then the Fed prints money and uses it to buy bonds (a lot of it government treasury bonds) from banks in exchange for that printed cash. This is called Quantitative Easing (QE). The amount the Fed pumped into the system this way was 4.5 trillion (that's with a T!). The idea is to get banks to lend that cash, get investments rolling, so the economy can get a kick-start. The cash that the Fed prints and spends is counted on their balance sheet (which is counted as government debt).

When the economy starts to recover, the Fed then "normalizes" everything, meaning they start raising interest rates and start selling the bonds they bought during the crisis back to the banks (or whoever they can sell it to).

When you look at both the DOW and the S&P they started going sideways in the beginning of 2018. There were violent peaks and dips, but the trajectory overall was sideways. 2018 is the year the Fed raised interest rates from 1.75-2.5%, the most dramatic rise since the crisis, and the most dramatic offloading of their balance sheet (they went from 4.4 trillion down to 3.7 before they stopped in Sept. 2019). So you can see where this action negatively affects the move of the markets.

Then both the DOW and the S&P shot back up to record highs once again around Sept. right when the Fed restarts QE. So far, the total is 230 billion they've pumped back into the system on top of the 3.7 trillion they already had on their balance sheet. I suspect this will never stop (we'll never hear anything about Fed normalization) at least not until after the election.

The fact that the market itself is sustaining the economy is evident when you look at past crashes. Unemployment is always a lagging indicator of recession. 2008 is a perfect example. In 2007, both the markets and the U3 were on trajectory peaks (the markets were going upward, and the U3 was going downward) right before the markets crashed, which then led to a recession. Once the market was propped back up with the trillions of dollars, the "recovery" then starts. U3 has reached unprecedented lows and markets reached unprecedented highs because the amount the Fed pumped into the system since 2008 to sustain it has been unprecedented.

You can clearly see the causation of all this. It has nothing, or very little to do with Obama or Trump.

Comment

-

Correct me if this summary is wrong. The Fed injects trillions into banks. Banks don't just let this money sit around, much of it is injected into companies and that's how the economy 'improves'. Indirectly, the government is lending lots of money at low interest rates to companies.Originally posted by seanD View PostThen both the DOW and the S&P shot back up to record highs once again around Sept. right when the Fed restarts QE. So far, the total is 230 billion they've pumped back into the system on top of the 3.7 trillion they already had on their balance sheet. I suspect this will never stop (we'll never hear anything about Fed normalization) at least not until after the election.

The fact that the market itself is sustaining the economy is evident when you look at past crashes. Unemployment is always a lagging indicator of recession. 2008 is a perfect example. In 2007, both the markets and the U3 were on trajectory peaks (the markets were going upward, and the U3 was going downward) right before the markets crashed, which then led to a recession. Once the market was propped back up with the trillions of dollars, the "recovery" then starts. U3 has reached unprecedented lows and markets reached unprecedented highs because the amount the Fed pumped into the system since 2008 to sustain it has been unprecedented.

An additional bandwagon effect, as money is injected into companies, the stock price goes up so other people buy the stock and put more money into companies.Remember that you are dust and to dust you shall return.

Comment

-

This is true. The companies borrow the money from the banks at low interest after the banks get it from the Fed. What do the companies do with it? They turn around and buy back their own stock, hence our "big fat ugly bubble" market in all its glory, which is why stock buybacks have also been unprecedented between 2008 and now. This is why our market is an illusion. The rest of the money the banks then turn around and deposit it back at the Fed to collect the interest. I kid you not. Very little, if any, of those trillions is actually reinvested into the main economy. This is why we have such a lopsided economy with insane wealth gaps (also unprecedented). This is the marvel of our lovely free market capitalist economy.Originally posted by demi-conservative View PostCorrect me if this summary is wrong. The Fed injects trillions into banks. Banks don't just let this money sit around, much of it is injected into companies and that's how the economy 'improves'. Indirectly, the government is lending lots of money at low interest rates to companies.

An additional bandwagon effect, as money is injected into companies, the stock price goes up so other people buy the stock and put more money into companies.

Comment

-

Originally posted by seanD View PostIt's pretty complex, but it goes like this. The market sustains the economy and the federal reserve sustains the market. Political polices do very little to affect this. Even Trump's tax cuts did little to affect it, at least permanently, and I'll show you why.

You can match the chronology of all this. During the crash of 2008, the federal reserve (Fed) lowered interest rates (it's not really that important to understand right now). Then the Fed prints money and uses it to buy bonds (a lot of it government treasury bonds) from banks in exchange for that printed cash. This is called Quantitative Easing (QE). The amount the Fed pumped into the system this way was 4.5 trillion (that's with a T!). The idea is to get banks to lend that cash, get investments rolling, so the economy can get a kick-start. The cash that the Fed prints and spends is counted on their balance sheet (which is counted as government debt).

When the economy starts to recover, the Fed then "normalizes" everything, meaning they start raising interest rates and start selling the bonds they bought during the crisis back to the banks (or whoever they can sell it to).

When you look at both the DOW and the S&P they started going sideways in the beginning of 2018. There were violent peaks and dips, but the trajectory overall was sideways. 2018 is the year the Fed raised interest rates from 1.75-2.5%, the most dramatic rise since the crisis, and the most dramatic offloading of their balance sheet (they went from 4.4 trillion down to 3.7 before they stopped in Sept. 2019). So you can see where this action negatively affects the move of the markets.

Then both the DOW and the S&P shot back up to record highs once again around Sept. right when the Fed restarts QE. So far, the total is 230 billion they've pumped back into the system on top of the 3.7 trillion they already had on their balance sheet. I suspect this will never stop (we'll never hear anything about Fed normalization) at least not until after the election.

The fact that the market itself is sustaining the economy is evident when you look at past crashes. Unemployment is always a lagging indicator of recession. 2008 is a perfect example. In 2007, both the markets and the U3 were on trajectory peaks (the markets were going upward, and the U3 was going downward) right before the markets crashed, which then led to a recession. Once the market was propped back up with the trillions of dollars, the "recovery" then starts. U3 has reached unprecedented lows and markets reached unprecedented highs because the amount the Fed pumped into the system since 2008 to sustain it has been unprecedented.

You can clearly see the causation of all this. It has nothing, or very little to do with Obama or Trump. Thanks!

Thanks!

But isn't this an artifact of a central banking system which isn't capitalist necessarily?Originally posted by seanD View PostThis is true. The companies borrow the money from the banks at low interest after the banks get it from the Fed. What do the companies do with it? They turn around and buy back their own stock, hence our "big fat ugly bubble" market in all its glory, which is why stock buybacks have also been unprecedented between 2008 and now. This is why our market is an illusion. The rest of the money the banks then turn around and deposit it back at the Fed to collect the interest. I kid you not. Very little, if any, of those trillions is actually reinvested into the main economy. This is why we have such a lopsided economy with insane wealth gaps (also unprecedented). This is the marvel of our lovely free market capitalist economy. "He is no fool who gives what he cannot keep to gain that which he cannot lose." - Jim Elliot

"He is no fool who gives what he cannot keep to gain that which he cannot lose." - Jim Elliot

"Forgiveness is the way of love." Gary Chapman

My Personal Blog

My Novella blog (Current Novella Begins on 7/25/14)

Quill Sword

Comment

-

I was being sarcastic.Originally posted by Teallaura View Post Thanks!

Thanks!

But isn't this an artifact of a central banking system which isn't capitalist necessarily?

I should have put "free market capitalist economy" in quotes. It's ANYTHING but free market capitalism. Folks continue to believe we're in a free market system I guess just out of ignorance this is going on. This is actually not too far from MMT that the leftist socialists are endorsing, maybe because they too are ignorant this is going on.

Comment

Related Threads

Collapse

| Topics | Statistics | Last Post | ||

|---|---|---|---|---|

|

Started by Cow Poke, Yesterday, 01:19 PM

|

9 responses

50 views

0 likes

|

Last Post

by seanD

Yesterday, 11:58 PM

|

||

|

Started by Hypatia_Alexandria, Yesterday, 12:23 PM

|

4 responses

32 views

0 likes

|

Last Post

by NorrinRadd

Today, 12:44 AM

|

||

|

Started by Cow Poke, Yesterday, 11:46 AM

|

16 responses

100 views

0 likes

|

Last Post

by Stoic

Yesterday, 04:44 PM

|

||

|

Started by seer, Yesterday, 04:37 AM

|

23 responses

106 views

0 likes

|

Last Post

by seanD

Yesterday, 02:49 PM

|

||

|

Started by seanD, 05-02-2024, 04:10 AM

|

27 responses

155 views

0 likes

|

Last Post

by seanD

Yesterday, 01:37 PM

|

Comment